Don't Worry About Your Credit Score

Real estate secured loans from $10,000 to $200,000 or more

Because you're a person, not a number. Borrow the money you need without regard to your credit score.

You're a person, not a number

You're a person, not a number

Consumer Use Loans

- Bill Consolidation

- Home Improvements

- Past Due Taxes

- Estate Settlement

We can help you to borrow the money you need without regard to your past credit history.

Learn More Learn MoreApproval for a Consumer Use Loan is primarily based on two factors:

1. You have sufficient equity in your property to adequately secure the loan.

2. You can prove that you have enough income to repay the loan.

No Credit Check

We will never pull your credit report, and we will not know your credit score.

Proof of Income

Federal and state laws require that we verify your ability to repay the loan. Therefore, we will ask you to prove your income, generally with your most recent pay stub and your W2 from last year. Work for yourself? You will most likely need to provide us with your tax returns. Every situation is different. Call us to find out more!

Evidence of Debts

Because we do not pull your credit report, we will ask you to provide us with a written listing of all of your debts. The federal government requires that we verify those debts. Therefore, we will ask you to provide us with the most recent billing statement for each of the listed debts. A note of caution, it is a federal crime, punishable by up to a $1,000,000 fine and 20 years in prison, to commit mortgage fraud. When we ask you to list your debts, we rely on you not to leave anything out.

Underwriting

Once we have proof of your income and your debts, we will look at the numbers and make sure that there is a reasonable likelihood that you can afford to repay the loan. Because Fairway is a private, "small-entity" lender, federal law gives us more leeway with our underwriting guidelines. Generally speaking, if your debt-to-income ratio is less than 50%, then we can help. But sometimes we can go higher, so please call to find out more!

Property Inspection

We will make a full inspection of the property being offered as the security for the loan. There is never a cost to you for this inspection. But please be advised that this is not an appraisal or a valuation.

Title Insurance

Once the inspection is done and the loan is approved, we will send you a Loan Commitment Letter, wherein Fairway commits to making you the loan. You will take this letter to a title company of your choosing. The title company will search your deed to make sure you have good title to your property. Fairway can help you find a title company in your area. Fairway will coordinate with your title company to setup the closing date and get you the money you need.

Close

Invest in Yourself

Invest in Yourself

Business Use Loans

- Rental Property Improvements

- Working Capital

- Equipment Purchases

- Startup Expenses

Borrow what you need. No credit check. Proof of income not required. We can help you invest in yourself.

Learn More Learn MoreApproval for a Business Use Loan is primarily based on one factor:

You have sufficient equity in your property to adequately secure the loan.

Proof of Income Not Required

When borrowing money for a verifiable business use, you do not need to prove your income.

No Credit Check

We will never pull your credit report, and we will not know your credit score.

Underwriting

Generally speaking, the lending decision is made strictly based upon the value of the collateral.

Property Inspection

We will make a full inspection of the property being offered as the security for the loan. There is never a cost to you for this inspection. But please be advised that this is not an appraisal or a valuation.

Title Insurance

Once the inspection is done and the loan is approved, we will send you a Loan Commitment Letter, wherein Fairway commits to making you the loan. You will take this letter to a title company of your choosing. The title company will search your deed to make sure you have good title to your property. Fairway can help you to find a title company in your area. Fairway will coordinate with the title company to setup the closing date and get you the money you need.

Close

It's Easy To Apply

Jarrod Menta, Loan Originator NMLS 141767

Jarrod Menta, Loan Originator NMLS 141767

Call and speak with our loan originator, Jarrod Menta.

Jarrod can answer all your questions, and give you all the information

you need to make a great borrowing decision.

We understand that you may have had financial difficulties in the past. Not a problem. We see you as a person, not a number.

Get the personal attention you deserve. Call Jarrod today!

Loan Quote

- No Application Fee

- Affordable Payments

- Fixed Rates

- No Prepayment Penalty

How much do you want to borrow?

We Want to Hear From You

CONTACT US

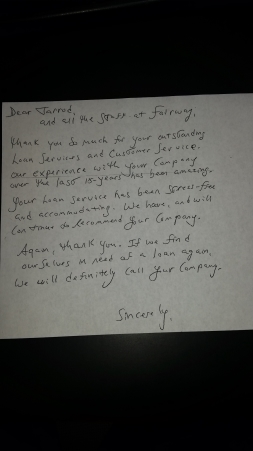

CONTACT USCustomer Testimonial

Here's a letter from a customer

Here's a letter from a customer

"Dear Jarrod and all the Staff at Fairway,

Thank you so much for your outstanding Loan Services and Customer Service. Our experience with your Company over the last 15-years has been amazing.

Your Loan Service has been Stress-Free and accommodating. We have, and will continue to Recommend your Company.

Again, thank you. If we find ourselves in need of a loan again, we will definitely call your company."